MEAG Participation Policy (Mitwirkungspolitik according to German Stock Corporation Act § 134b Abs. 1 AktG)

1. Preamble

As an asset manager, MEAG MUNICH ERGO Kapitalanlagegesellschaft mbH (hereinafter MEAG) is obliged pursuant to Section 134b (1) of the German Stock Corporation Act (AktG) to describe and publish how it is involved in its portfolio companies. MEAG will explain the following topics in more detail:

- How MEAG exercises shareholder rights and integrates shareholder engagement in their investment strategy

- How MEAG monitors relevant issues in the portfolio companies

- How MEAG communicates with relevant stakeholders of the investee companies

- How MEAG cooperates with other shareholders, and

- How MEAG deals with conflicts of interest in relation to their engagement

2. Exercising shareholder rights

In general, MEAG exercises the shareholder rights to which it is entitled for domestic and foreign shares in its fund holdings.

As a rule, MEAG does not attend general meetings itself because of the costs involved. Instead, it asks one of the following entities to exercise the voting rights as instructed in detail.

- The custodian

- An independent voting proxy (e.g. shareholder association)

- A voting proxy for the company in question

- A company that specialises in analysing companies and representing third parties at general meetings (e.g. Glass Lewis)

If votes can be cast on the company's homepage, MEAG may vote itself without commissioning a third party.

3. Exercising shareholder rights as part of the investment strategy

Our investors are predominantly insurance companies that structure their investment portfolios to align with the calculated timing and amounts of potential insurance claims, and with balance sheet and income requirements. Our investment strategy is accordingly based on the statutory demands on the investment principles of security, quality, liquidity, profitability and sustainability, as dictated to us by our investors.

This results in requirements that we as MEAG have to meet using suitable methods, taking into account consequences for the fungibility of the managed shares, the portfolio's maturity structure, investment currencies and risk concentrations in individual counterparties or sectors.

Our investors take particular influence over our tactical execution of the investment strategy by restricting investments in equities with quotas and limits.

4. Monitoring relevant issues in the portfolio companies

With its Proxy Voting Policy MEAG makes sure to vote for measures that may have a positive long-term impact on the company's development and votes against measures that may have a negative impact on the company. MEAG is aided in this by analyses from external proxy voting agents such as Glass Lewis.

In addition to critical factors such as

- the company's strategy,

- the financial and non-financial performance and risk, and

- the company's capital structure,

we also consider and analyse things such as social, ecological and governance (ESG) aspects, looking into whether the company adheres to sustainability standards, codes and principles, whether it documents its strategy for doing business responsibly in writing and whether it provides information on its activities and ESG principles, e.g. with regard to climate, environmental aspects, employee concerns, respect for human rights and the combating of corruption.

MEAG assesses the roles and responsibilities of the management board and its committees, to understand the level of oversight they exercise over sustainability and climate-related risks and opportunities.

We also expect issuers to disclose all sustainability and climate-related risks, either in their reports to the Task Force on Climate-Related Financial Disclosures (TCFD), the Carbon Disclosure Project (CDP) or in a sustainability report, so that we as a shareholder can assess how the company is addressing climate change issues, and environmental and social factors. We assess how a company manages ESG-related risks and climate change according to how ESG risks, in particular climate risks, are incorporated into the top management's bonus structures, and we judge the company's climate-change strategy based on whether it has set itself Net Zero reduction goals.

In order to always keep abreast of important matters in the portfolio companies, the MEAG portfolio managers evaluate annual reports, internet publications and analyses done by internal and external research providers. MEAG also takes the opportunity to contact the company's corporate bodies and stakeholders directly.

5. Communication with companies' corporate bodies and relevant stakeholders

MEAG talks directly with the companies' board members.

6. Cooperate with other shareholders

MEAG does not act in concert with other shareholders when voting on a company's business orientation at a general meeting.

MEAG examines shareholder proposals from other asset managers and shareholders on the agenda of a company's general meeting on a case-by-case basis and support the proposals if they are in our investors' best interests.

7. Dealing with conflicts of interest and securities loans

MEAG votes only in the interests of its own financial investors, and not in those of third parties.

It refrains from any abuse of the position as minority shareholder.

In doing so, our portfolio management analyses the above factors independently.

Within its investment strategy, MEAG may transfer shareholdings to third parties in securities lending transactions. If it does, it could lose the possibility to exercise its voting rights, as these rights then transfer to the third party.

However, MEAG has contractual agreements with the business partners involved to ensure that securities lending transactions are terminated before the start of an AGM. Accordingly, MEAG exercises its voting rights itself.

If a conflict of interest to the detriment of an investor arises, MEAG resolves it in the best interests of the investors concerned. MEAG has internal guidelines for such cases, which ensure that conflicts of interest are avoided and that unavoidable ones are dealt with and disclosed appropriately. Further information on how MEAG deals with conflicts of interest can be found in our Conflict of Interest Policy.

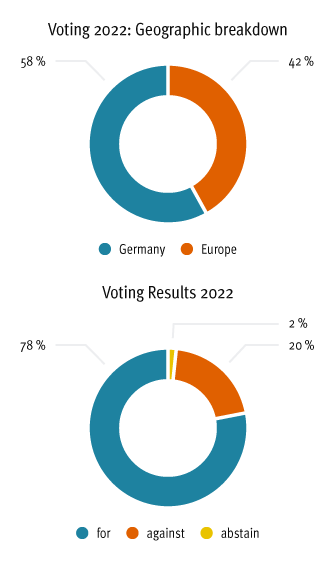

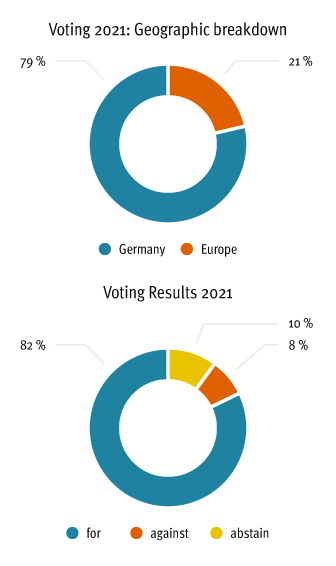

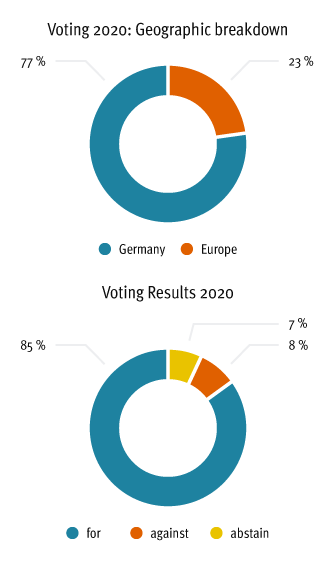

8. Disclosure about the exercising of voting rights

All voting decisions are made transparently. Records of voting decisions are publicly available.

Details are provided in MEAG's annual reports pursuant to Section 134b (2) and (3) of the German Stock Corporation Act (AktG).